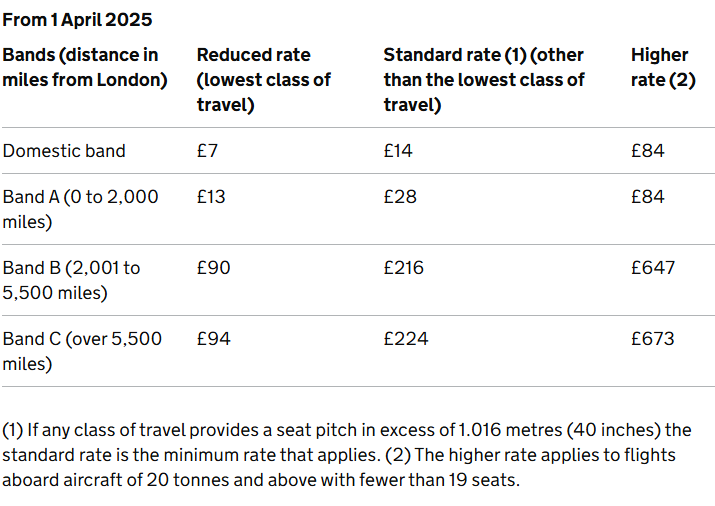

The UK set tax rates on private jets for the period from 1 April 2025 to 31 March 2026. The amount will vary based on the flight distance from London to the destination.

The government notes that evidence indicates these jets are typically owned by businesses or individuals of “considerable wealth”.

The purpose of the policy is to keep tax levels aligned with inflation and ensure that airlines and other aircraft operators continue to contribute fairly to public finances. The government expects the higher rates to influence behavior changes, such as potential shifts in flight activity in response to the updated tax rates, while also supporting net-zero goals by encouraging the private jet industry to invest in low-carbon technologies.